Transition Brings Opportunity: 2017 Regulatory Year in Review

Looking back at 2017, a theme became clear: transition. From a new President and HUD Secretary to a new Congress to a new NAHRO Chief Executive Officer, 2017 brought the affordable housing and community development industry many opportunities for change.

The year began with a bang as the Obama administration released regulations on smoke-free public housing and lead-safe housing, along with an operation notice on the expansion of the Moving to Work demonstration. The Trump administration took office and immediately implemented, as is tradition, a regulatory freeze to review the previous administration’s regulations and notices. HUD’s publicly released rules and notices were reviewed and allowed to continue. In an effort to deregulate Federal agencies, including HUD, the Trump Administration also issued an Executive Order to form a Regulatory Review Task Force at each department and mandated a remove-then-replace policy for creating new regulations. Many of HUD’s actions in 2017 also move towards deregulation.

This article will walk through many of the affordable housing and community development regulations and programs that were of prominence in 2017. The regulations and programs have been grouped into Community Development, Section 8, Public Housing, and cross-cutting programs.

Community Development Programs

Low-Income Housing Tax Credit (LIHTC)

The Low-Income Housing Tax Credit (LIHTC or “Housing Credit”) is our nation’s most successful tool for encouraging private investment in the production and preservation of affordable rental housing. LIHTCs have been a critical source of equity for almost 3 million affordable housing units over the last 30 years, providing affordable homes to 6.7 million low-income families and supporting 3.25 million jobs. Virtually no affordable rental housing development would occur without LIHTC, and the Housing Credit is now a vital financing component for many of the federal, state, and local affordable housing programs that NAHRO members are engaged.

Following the 2016 Presidential election, the increased likelihood of major changes to the federal tax code, including a reduction in the corporate tax rate, introduced uncertainty into the LIHTC market. Investors were wary of participating in this affordable housing program and were reassessing the value and benefits of investing in LIHTC projects. As a result, there were disruptions in the LIHTC equity market and projects in the pipeline are being delayed, closed with less equity, or canceled due to funding gaps. There is no shortage of demand for LIHTCs and there is still strong bipartisan support for LIHTC in Congress. On March 7, Senator Maria Cantwell (D-WA) and Senate Finance Committee Chairman Orrin Hatch (R-UT) introduced the Affordable Housing Credit Improvement Act of 2017 (S. 548,) a comprehensive and bipartisan bill that would strengthen and expand LIHTC. S. 548 takes steps toward addressing the affordable housing deficit by increasing the overall Housing Credit allocation authority and establishing a permanent 4 percent Housing Credit rate. The legislation also includes provisions that would streamline and modernize LIHTC, increase financial feasibility for projects, and encourage development in underserved areas. The bill would also support the development of rental units that use LIHTC in conjunction with multifamily Housing Bonds, which currently provide important financing to about 40 percent of all Housing Credit apartments.

In December 2017, Congress passed and the President signed a tax reform bill that maintains tools important to the creation and preservation of affordable housing and the economic development of towns and cities across the country. While the bill preserves private activity bonds, LIHTC, New Market Credits, and Historic Tax Credits, which all play critical roles in community improvement, the LIHTC strengthening and expansion provisions of S. 548 are still needed.

Housing Trust Fund (HTF)

On June 14, HUD allocated approximately $219 million in FY 2017 formula funds to eligible grantees of the National Housing Trust Fund (HTF) program. The HTF is a new, non-appropriated federal resource that complements existing Federal, State and local efforts to preserve and expand the nation’s supply of affordable homes for very low-income (VLI) and extremely low-income (ELI) households, as well as families experiencing homelessness. Authorized in 2008, lawmakers sought to establish a permanent source of affordable housing funding through annual contributions from Fannie Mae and Freddie Mac (GSEs). Eight years later, the HTF was finally capitalized through its inaugural FY 2016 allocations. HTF grantees include the 50 states, District of Columbia, and five U.S. Insular Areas. Grantees may distribute funds through subgrantees (a unit of general local government or state agency) or directly fund projects proposed by eligible recipients (including PHAs), or a combination of both. HTF dollars may be invested in public housing, but only in conjunction with Choice Neighborhoods, Low-Income Housing Tax Credits (LIHTCs), or the Rental Assistance Demonstration (RAD).

While the FY 2017 HTF allocations were allocated as expected this year, the future of the program may be in jeopardy. As it did in previous years, Congress may introduce a bill to eliminate or divert HTF funding to other programs. Additionally, the Federal Housing Finance Agency (FHFA) holds authority over the GSE’s HTF contributions. Once the current FHFA Director’s term completes in 2019, and if Congress moves forward with housing finance reform, the status of the HTF may come into question.

FY 2017 Housing Trust Fund Allocations (Totals – $219,168,374) | |||||||

Calif. | $23,228,115 | N.J. | $5,599,220 | Wash. | $4,129,304 | Tenn. | $3,160,279 |

N.Y. | $14,790,240 | Ohio | $5,511,230 | Va. | $3,821,341 | Colo. | $3,154,331 |

Texas | $8,858,738 | Mich. | $4,851,072 | Wis. | $3,481,414 | Ore. | $3,143,231 |

Fla. | $7,658,948 | Mass. | $4,604,660 | Ind. | $3,367,317 | Minn. | $3,118,428 |

Ill. | $7,163,487 | N.C. | $4,433,361 | Mo. | $3,357,775 | Md. | $3,071,109 |

Pa. | $5,863,425 | Ga. | $4,427,950 | Ariz. | $3,317,255 |

| |

Ala., Alaska, Ark., Conn., Del., D.C., Hawaii, Idaho, Iowa, Kan., Ky., La., Maine, Miss., Mont., Neb., Nev., N.H., N.M., N.D., Okla., R.I., S.C., S.D., Utah, Vt., W.Va., Wyo. | $3,000,000 | ||||||

Five U.S. Insular Areas | $1,056,144 | ||||||

Section 8 Programs

Small Area Fair Market Rents (SAFMR)

HUD released the Small Area Fair Market Rents (SAFMRs) final rule towards the end of 2016. SAFMRs are FMRs that are determined on the basis of a zip code, instead of on the basis of an entire metropolitan area. By setting payment standards by SAFMRs in certain areas, HUD believes that it will make areas of higher opportunity and lower poverty available to program participants. The final rule also exempts all project-based vouchers from the mandatory application of SAFMRs, but allows PHAs that use SAFMRs for their tenant-based vouchers, the option of using them for their project-based vouchers too.

HUD finalized the Small Area FMR rule in late 2016. The rule included policy provisions that applied to all PHAs with HCV programs, while also requiring that 24 metropolitan areas mandatorily impose Small Area FMRs. In the summer of 2017, HUD used its authority under the rule to suspend the mandatory implementation of SAFMRs in 23 of the previously designated areas. Recently, a federal court enjoined this suspension of the mandatory components of SAFMR implementation, meaning that mandatory implementation in designated areas is once again required. Following the court order, NAHRO repeatedly asked HUD for timely publication of guidance to assist PHAs with this; eventually, HUD published PIH-2018-01 (HA) to provide implementation guidance.

Uniform Physical Condition Standards for Vouchers (UPCS-V)

HUD is in the process of transitioning its inspection protocol from the current Housing Quality Standards (HQS) to the new Uniform Physical Condition Standards for Vouchers (UPCS-V) protocol. The new protocol would have a new system for describing and classifying deficiencies, and would also allow for greater information technology integration. It would also include a new data transmission tool that would allow data taken from the inspection to be turned into a unit condition index, which would provide information about the state of the unit to tenants, homeowners, and PHAs. HUD envisions the use of a handheld portable device, which would capture deficiencies, photographic evidence, and other inspection findings.

Currently, HUD is in the process of conducting a UPCS-V Demonstration. Data collected from the Demonstration will be used to refine the protocol and make necessary changes. NAHRO is closely monitoring the demonstration to see how the UPCS-V protocol is being implemented and is working with HUD to make sure that any final protocol takes into consideration the viewpoints of our membership.

Public Housing Programs

Preserving Public Housing

The need to preserve Public Housing and improve access to capital financing tools has not gone unnoticed by Congress. By adding Section 30 to the US Housing Act of 1937, the Quality Housing and Work Responsibility Act (QHWRA) provided PHAs with the tools required to access capital markets and begin to address these needs. Section 30 allows PHAs to mortgage or otherwise grant a security interest in any public housing project or other property of the public housing agency through the Public Housing Mortgage Program (PHMP). The PHMP allows PHAs to place a mortgage or other encumbrance on public housing properties where the subject property is owned by the PHA.

Unfortunately, HUD’s regulations regarding the use of the PHMP greatly limit the ability of PHAs to utilize this funding stream. Currently, HUD prohibits the subordination of the “federal interest” (the Declaration of Trust) in public housing dwelling units. By maintaining that the declaration of trust must remain in first lien position, HUD limits the value of the public housing real estate as collateral and severely reduces the potential utility of Section 30.

The report noted HUD’s concerns about residents living in potentially foreclosed public housing properties. As a potential solution, the report includes a NAHRO provision that would increase tenant protections for residents that live in developments undergoing modernization through Section 30 financing, and notes the need for statutory changes to allow residents to qualify for these specific tenant protections. Although HUD thinks there may be ways to statutorily improve tenant-protections for residents of PHAs utilizing the PHMP, HUD remains concerned about protecting the federal interest of public housing. NAHRO will continue working with HUD to improve PHA access to Section 30 in order to provide PHAs with a range of options that can help restore the physical and financial health of public housing.

Public Housing Operating Fund

In 2017, the Operating Fund proration increased from 2016, even though overall funding decreased. The FY 2017 omnibus provided $4.4 billion to support the operation and management of public housing — $100 million less than FY 2016 funding levels. Although 2017 Operating Fund levels were lower than 2016 levels, the amount provided by the omnibus was sufficient to fund 92.9 percent of PHAs’ anticipated formula eligibility for 2017, higher than the 2016 proration. This was due to declines in Operating Fund formula eligibility from 2016 to 2017. Eligibility is determined by project expense level (PEL), including income, the utility expense level (UEL), add-ons, and transition funding. High formula PEL income inflation factors, coupled with UEL deflation due to declining oil and natural gas costs, led to a decline in income eligibility.

For 2017, HUD applied inflation factors between 6 percent and 8 percent for 2017 formula income. This was significantly higher than HUD’s inflation factor for any other year, and was most likely driven by external occurrences. HUD also applied a 7.01 percent deflation factor for the utility expense level (UEL) due to declines in oil and natural gas costs. HUD uses data from the Bureau of Labor Statistics Consumer Price Index for All Urban Consumers (CPI-U) to determine utility expense levels. HUD applies this deflation factor at the national level, regardless of the energy source used by an Asset Management Project (AMP). Although AMPs that utilize oil or natural gas have seen savings, those that rely on other sources of energy have not.

Many PHAs experienced significant subsidy decreases in early 2017 due to declining formula eligibility for the Public Housing Operating Fund and a conservative Operating Fund proration. HUD employed such a conservative proration (85 percent) for the beginning of the year as Congress had yet to pass a budget for FY 2017. PHAs experienced decreases in Operating Fund subsidies earlier in the year due to HUD’s use of an 85 percent proration for January, February, March, April and May. The 2017 data, which included the income inflation factors and utility expense level deflation, were first applied to subsidy calculations in March.

At this time, many PHAs saw an additional decrease in their subsidy. On top of this, because HUD used 2016 data for January and February, which were based on higher formula eligibility than 2017 data, HUD overpaid agencies for those months. As such, some PHAs saw a dramatic decline in their Operating Fund subsidy in March as HUD had to “true-up” the subsidy – this often involves HUD providing a lower subsidy for the month to account for the over-payments in January and February. Once the FY 2017 budget was passed, PHAs also saw a “true up” for June funding due to the increase in the proration.

Smoke-Free Public Housing

HUD’s Instituting Smoke-Free Housing Final Rule requires public housing agencies (PHAs) administering public housing to implement smoke-free policies that prohibit lit tobacco products in all living units, indoor common areas in public housing, and in PHA administrative office buildings. The final rule requires smoke-free policies to extend to all outdoor areas up to 25 feet from housing and administrative office buildings (restricted areas). The rule requires the prohibition of indoor smoking and smoking in restricted areas to be included in a tenant’s lease. PHAs have until July 30, 2018 to establish compliant smoke-free policies. PHA plans need to be updated to reflect the smoke free policy and to incorporate the required new lease provisions during tenants’ recertifications or at a date before the policy is fully effective. PHAs with existing smoke-free policies have this time to review their policies to ensure that they are in compliance with the final rule.

On February 15, HUD Released Notice PIH-2017-03, “HUD Guidance on Instituting and Enforcing Smoke-Free Public Housing Policies.” The notice describes the required PHA plan and lease amendments, flexibilities afforded to PHAs while creating their smoke-free policy, signage requirements, funding, and designated smoking areas.

Cross-Cutting Programs

Violence Against Women Act of 2013 (VAWA 2013)

Last year, HUD published a final rule that fully codifies the provisions of the Violence Against Women Reauthorization Act of 2013 (VAWA 2013) into HUD regulations and expands housing protections for victims of domestic violence, dating violence, sexual assault, or stalking to include HUD Community Planning and Development (CPD) programs. Most of the rule’s provisions became effective December 2016 while its emergency transfer plan (ETP) provisions, which require covered housing providers (HPs) to allow an eligible tenant to make an internal transfer (where the tenant would not have to apply for the new unit) when there is a safe unit is immediately available, became effective in June 2017. The final rule makes clear that ETP requirements do not supersede any eligibility or occupancy requirements that exist in covered housing program.

The rule establishes a low barrier certification process for transfers. The final rule requires the elements below to be incorporated into an Emergency Transfer Plan:

- Policies for the measure of any priority given to VAWA victims.

- Policies for internal transfer when safe unit is immediately available and the reasonable efforts that the HP will take to assist a tenant to transfer to a safe unit.

- Policies for internal transfer when a safe unit is not immediately available.

- Policies for reasonable efforts for an external transfer, such as arrangements, including MOUs, with other HPs moves; and outreach activities to victim organizations.

- Policies that allow internal and external transfer to occur concurrently.

- Policies for strict confidentiality measures to ensure the location of the new unit is not.

- Policies for tenants receiving Tenant-Based Rental Assistance to move quickly with assistance, when applicable.

- ETPs must be available upon request and publicly available when feasible. All requests and request outcomes must be recorded and retained for at least three years and annually reported to HUD-though HUD has not yet required HPs to report this information.

HPs should note that the final rule codifies additional VAWA-related provisions within each covered house program’s regulations. For example, the rule alters the PBV program’s “family right to move” provisions so that families are not required to notify a PHA before they leave a unit in order to protect the health and safety of a VAWA victim. HPs should make sure to incorporate the rule’s program specific provisions, along with other elements that may be specific to their own programs.

Moving to Work (MTW)

In its FY 2016 Appropriations Act, Congress directed HUD to expand the Moving to Work (MTW)Demonstration to include 100 additional high-performing PHAs over the next seven years. Congress also called on HUD to establish a federal research advisory committee that includes program and research experts from HUD agencies with an MTW designation and independent subject matter experts in housing policy research. NAHRO has long called for meaningful expansion of the MTW Demonstration and is deeply supportive of the Congress’s efforts.

On January 23, HUD published in the Federal Register a notice titled “Operations Notice for the Expansion of the Moving to Work (MTW) Demonstration Program Solicitation of Comment,” which establishes the requirements for the implementation and continued operations of the MTW Demonstration program pursuant to the MTW Expansion Statute. In response to the comments it received, HUD hosted four listening sessions on the MTW Expansion Operations Notice and gathered additional feedback, most of which mirrored NAHRO’s comments. HUD then reopened the comment period for the MTW expansion operations notice on May 4 to receive additional written feedback. HUD has yet to finalize the Operations Notice for the MTW Expansion. HUD has not yet released a request for applications for the MTW expansion; it has also not announced the policies the expansion will evaluate.

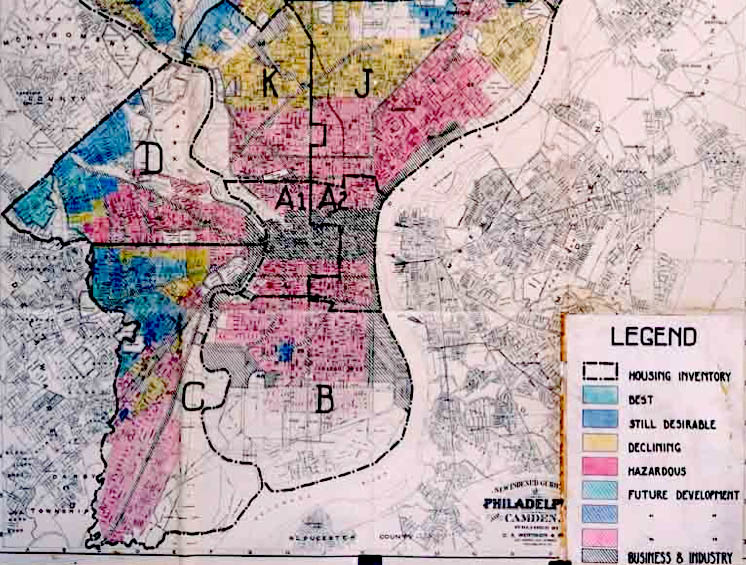

Affirmatively Furthering Fair Housing (AFFH)

Affirmatively Furthering Fair Housing (AFFH) is a legal requirement that federal agencies and federal grantees further the purposes of the Fair Housing Act. This obligation to affirmatively further fair housing has been in the Fair Housing Act since 1968.

HUD’s AFFH final rule requires a comprehensive planning approach to help program participants take actions to overcome historic patterns of segregation, promote fair housing choice, and foster inclusive communities that are free from discrimination. This includes analyzing the local fair housing landscape and setting fair housing priorities and goals through the Assessment of Fair Housing (AFH) process, which replaces the Analysis of Impediments (AI). HUD is currently in different stages of drafting the four AFH tools (States and Insular Areas/ Local Government/PHA Only/Qualified PHA Only). The rule identifies four fair housing issues that program participants will assess using local data and data provided by HUD:

- Patterns of integration and segregation;

- Racially or ethnically concentrated areas of poverty;

- Disparities in access to opportunity; and

- Disproportionate housing needs.

HUD has completed a “Local Government and Joint/Regional” tool and a “PHA and PHA-only Collaboration” tool (though the data for the PHA-tool has not been published). The “Qualified PHA (QPHA)” tool and the State and Insular Area tool have yet to be finalized. As of January 2018, HUD has delayed submission of all Local Government AFHs that have not yet been approved by HUD until their submission date after 2020.

Rental Assistance Demonstration (RAD)

According to HUD, the Rental Assistance Demonstration (RAD) was created “in order to give public housing authorities (PHAs) a powerful tool to preserve and improve public housing properties and address the $26 billion dollar nationwide backlog of deferred maintenance.” Through RAD, PHAs are able to convert their public housing units to a Section 8 platform with a long-term contract that must be renewed. Currently, RAD has leveraged almost $4.3 billion in total construction activity.

RAD was authorized as a part of the Consolidated Appropriations Act of 2012. Initially, the number of units to be converted through RAD was capped at 60,000. This cap was increased to 185,000 units in 2015 and again in 2017 to 225,000 units. The 2017 Appropriations Act also changed the September 30, 2018 deadline for submission of RAD applications under the first component to September 30, 2020.

On August 23, 2017, HUD released a notice that increased the unit cap for RAD as mandated by the 2017 Appropriations Act and set rents for units converted under the increase. PHAs that had already submitted Letters of Interest (LOI) to reserve their position on the RAD waiting list became eligible for award under this expansion if the PHA submitted a complete RAD Application, Portfolio Award, or Multi-phase Award for the number of units identified in their LOI by October 23, 2017. Those that did not submit a complete application by this date forfeited their position on the waiting list, allowing other PHAs on the waiting list to become eligible for the expansion spots.

PHAs that are issued Multi-phase Awards after May 5, 2017 will have until September 30, 2020 to submit an application for the final phase of the project. HUD may approve extensions up to September 30, 2020 for Multi-phase Awards made prior to May 5, 2017 on a case-by-case basis.

The FY 2018 Senate T-HUD Appropriations bill aims to eliminate the September 20, 2020 deadline for the submission of RAD applications under the first component and eliminate the cap on conversions. The FY 2018 House T-HUD Appropriations bill does not do this.

Looking Forward

As we begin 2018, the theme of deregulation will continue and probably expand to additional areas such are self-sufficiency, work force development, and rent reform, to name a few. HUD has released information of a demonstration program of EnVision Centers that will act as a centralized attempt to encourage self-sufficiency by supporting local communities through the four pillars of: (1) Economic Empowerment, (2) Educational Advancement, (3) Health and Wellness, and (4) Character and Leadership. The Administration’s FY 2019 budget proposal has a discussion of work force development and rent reform. While laying out the concepts of work force development and rent reform, many details are missing and we hope for more details from the administration in Spring 2018.

NAHRO will continue to advocate for local control to give housing authorities broader decision-making abilities that relate more specifically to local conditions and that will allow PHAs to house residents in the most efficient and effective manner. Additionally, NAHRO will seek full funding for implementation of regulations to ensure that all housing authorities have the resources needed to meet their requirements.

In order to take advantage of the opportunities that transition brings, we need to be both informed and prepared. NAHRO will continue to provide its members with the information and analysis they need to continue the vital work that you do in your communities and to advocate for the people they serve and the programs that enable their work.

More Articles in this Issue

News Briefs

People FHLBank San Francisco Names Marietta Núñez Community Investment Officer On February 15, 2018, the…Awards of Excellence: Speakers of the House

The King County Housing Authority (Wash.) won a 2017 Award of Excellence for its initiative to…Awards of Excellence: Referral Voucher Program

The Spokane Housing Authority (Wash.) designed a one-year pilot program to collaborate with local agencies…Meet the 2017-2019 NAHRO Leadership

NAHRO President: Carl S. Richie, Jr., NCC, NAHRO-Fellow Chairman, Board of Commissioners Housing Authority of…Walls and Bridges, Part 2: How Our Past Choices and Current Biases Continue to Shape Our World

What you leave behind is not what is engraved in stone monuments, but what is…Awards of Excellence: Homelessness – Let’s Talk About It!

The County of San Diego Housing and Community Development Services (Calif.) wins a 2017 Award…